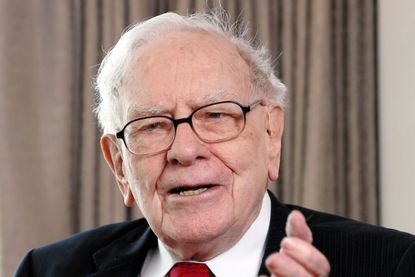

Warren Buffett Stocks: Analyzing The Berkshire Hathaway Portfolio

The Berkshire Hathaway portfolio is a diverse set of blue chips and some lesser-known growth bets. Here, we look at all stocks picked by Buffett and his team.

Warren Buffett's stock picks are not what they used to be. Indeed, the Berkshire Hathaway (BRK.B) equity portfolio has changed dramatically over the past few years. Although old-guard favorites such as American Express (AXP) and Coca-Cola (KO) still form the core of the portfolio, Buffett & Co. have taken a shine to names such as Apple (AAPL) and Amazon.com (AMZN), and even to lesser-known firms such as Snowflake (SNOW) and Nu Holdings (NU).

One thing that hasn't changed, however, is Buffett's preference for maintaining a highly concentrated portfolio. Apple accounts for more than half of Berkshire Hathaway's U.S. stock portfolio, while the five largest holdings comprise more than 80%. The top 10 holdings account for 93%.

But whether we're talking about Berkshire's biggest bets or the scores of stocks it maintains at the margins, Buffett's focus shifted after the COVID-19 pandemic.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Buffett owned airline stocks at the start of 2020; now he holds none. Banks were aces among Buffett stocks to begin 2020; Berkshire spent the past few years kicking most of them to the curb. And it seems like only yesterday that Buffett was an enthusiastic buyer of select pharmaceutical names. Today, most of those positions have been closed out too.

If you want to know which stocks legendary investor Warren Buffett feels are worth his time and attention, look no further than the Berkshire Hathaway equity portfolio. (And as always, remember: A number of these stocks were actually picked by co-portfolio managers Todd Combs and Ted Weschler.)

Read on as we highlight the entire Berkshire Hathaway portfolio, take a closer look at the stocks Warren Buffett is buying and selling, and drill down on a handful of his top stock picks.

Price, share totals and other data as of December 31, 2023. Sources: Berkshire Hathaway’s SEC Form 13F filed February 14, 2024, for the reporting period ended December 31, 2023; and WhaleWisdom.

The entire Berkshire Hathaway portfolio

| Company | Shares held | Holding value | Percent of portfolio |

|---|---|---|---|

| Apple (AAPL) | 905,560,000 | $174,347,466,800 | 50.19% |

| Bank of America (BAC) | 1,032,852,006 | $34,776,127,042 | 10.01% |

| American Express (AXP) | 151,610,700 | $28,402,748,537 | 8.18% |

| Coca-Cola (KO) | 400,000,000 | $23,572,000,000 | 6.79% |

| Chevron (CVX) | 126,093,326 | $18,808,080,506 | 5.41% |

| Occidental Petroleum (OXY) | 248,103,025 | $14,136,910,364 | 4.06% |

| Kraft Heinz (KHC) | 325,634,818 | $12,041,975,570 | 3.46% |

| Moody's (MCO) | 24,669,778 | $9,635,028,496 | 2.77% |

| DaVita (DVA) | 36,095,570 | $4,454,554,294 | 1.28% |

| Citigroup (C) | 55,244,797 | $2,841,792,358 | 0.82% |

| Verisign (VRSN) | 12,815,613 | $2,595,546,101 | 0.76% |

| Kroger (KR) | 50,000,000 | $2,285,500,000 | 0.66% |

| Visa (V) | 8,297,460 | $2,160,243,711 | 0.62% |

| Mastercard (MA) | 3,986,648 | $1,700,345,238 | 0.49% |

| Capital One Financial (COF) | 12,471,030 | $1,635,201,454 | 0.47% |

| Amazon.com (AMZN) | 10,000,000 | $1,519,400,000 | 0.44% |

| Liberty Sirius XM Group Class C (LSXMK) | 48,499,472 | $1,505,908,606 | 0.43% |

| Charter Communications (CHTR) | 3,828,941 | $1,488,232,788 | 0.43% |

| Snowflake (SNOW) | 6,125,376 | $1,218,949,824 | 0.35% |

| Aon (AON) | 4,100,000 | $1,193,182,000 | 0.34% |

| Ally Financial (ALLY) | 29,000,000 | $1,012,680,000 | 0.29% |

| Paramount Global (PARA) | 63,322,491 | $892,299,471 | 0.26% |

| Nu Holdings (NU) | 107,118,784 | $776,611,184 | 0.25% |

| T-Mobile US (TMUS) | 5,242,000 | $840,449,860 | 0.24% |

| Liberty Sirius XM Group Class A (LSXMA) | 23,740,032 | $739,501,996.8 | 0.21% |

| HP (HPQ) | 22,852,715 | $687,638,195 | 0.20% |

| Floor & Decor (FND) | 4,780,000 | $533,256,800 | 0.15% |

| Louisiana Pacific (LPX) | 7,044,909 | $498,990,904 | 0.14% |

| Formula One Group (FWONK) | 7,722,451 | $487,518,332 | 0.14% |

| Liberty Media (LLYVK) | 11,132,590 | $416,247,540 | 0.12% |

| Sirius XM Holdings (SIRI) | 40,243,058 | $220,129,527 | 0.06% |

| Liberty Media (LLYVA) | 5,051,918 | $184,647,602 | 0.05% |

| NVR (NVR) | 11,112 | $77,789,000 | 0.02% |

| Diageo (DEO) | 227,750 | $33,174,065 | 0.01% |

| Lennar (LEN) | 152,572 | $20,452,277 | 0.01% |

| Liberty Latin America Class A (LILA) | 2,630,792 | $19,231,089 | 0.01% |

| Vanguard S&P 500 ETF (VOO) | 43,000 | $18,782,400 | 0.01% |

| SPDR S&P 500 Trust ETF (SPY) | 39,400 | $18,727,214 | 0.01% |

| Jefferies (JEF) | 433,558 | $17,520,079 | 0.01% |

| Liberty Latin Americ Class C (LILAK) | 1,284,020 | $9,424,707 | less than 0.01% |

| Atlanta Braves Holdings (BATRK) | 223,645 | $8,851,870 | less than 0.01% |

Stocks Warren Buffett is buying

Warren Buffett took advantage of weakness in the energy sector to add to two of his favorite oil stocks at the end of 2023.

Shares in Chevron (CVX), the only energy name among Dow Jones stocks, spent much of Q4 trading below $150 a share. Occidental Petroleum (OXY) meanwhile, spent a good chunk of December below $60 a share. Buffett has tended in the past to pick up CVX and OXY when they slip below those respective levels, so it shouldn't come as too much of a surprise that he added to both holdings in Q4.

Berkshire upped its CVX stake by 14.4%, or almost 16 million shares. With 126 million shares worth $18.8 billion, the energy major is BRK.B's fifth largest holding at 5.4% of the portfolio (down from almost 6% three months ago).

As for OXY, Berkshire raised its stake by 8.7%, or 19.6 million shares. At 4.2% of the portfolio – down from 4.6% three months ago – OXY is Berkshire's sixth largest position.

Lastly, Berkshire quadrupled its ownership of Sirius XM Holdings (SIRI). However, at 0.6% of the BRK.B portfolio, SIRI remains an immaterial position. Berkshire initiated a small stake in John Malone-backed SIRI in the third quarter of 2023. (BRK.B has owned SIRI before, exiting a small stake back in 2021.)

Stocks Warren Buffett is selling

News that Warren Buffett trimmed his Apple stake at the end of 2023 grabbed the most headlines of all his other buys and sells. However, the Q4 stock sales look more like an attempt to keep the iPhone maker's weight in the Berkshire portfolio from getting too out of whack.

AAPL stock rallied more than 12% in the final three months of last year. Berkshire responded by reducing its position by 1%, or 10 million shares. And yet even after lightening up, Apple still accounts for 50.2% of Berkshire's total portfolio value, up from 50% three months ago.

Elsewhere on the sell side of Berkshire's ledger, things were a bit busier.

In addition to trimming Apple, Buffett slashed BRK.B's stake in HP (HP) by 78%. Buffett initiated a commanding position in the PC and printer maker back in 2022. At the time, HP looked like a classic Buffett value play, but that didn't quite work out. HPQ now comprises 0.2% of the BRK.B portfolio. That's a sharp drop from 0.84% last quarter.

Elsewhere, BRK.B cut its stake in Paramount Global (PARA) by a third. PARA now accounts for just 0.27% of the portfolio, down from 0.39% a quarter ago.

And finally, in a series of exits, BRK.B completely sold out its positions in D.R. Horton (DHI), StoneCo (STNE), Markel (MKL) and Globe Life (GL). DHI had comprised just 0.2% of the BRK.B portfolio, while the other three stocks accounted for less than 0.1%.

Warren Buffett's top stock picks

Apple

Buffett has said that "I think of [Apple] as our third business." It might as well be. The tech giant represents more than 50% of the assets in the Berkshire Hathaway equity portfolio. And Berkshire is Apple's third-largest investor. Only Vanguard and BlackRock – giants of the passively managed index fund universe – hold more Apple stock.

The Oracle of Omaha has only occasionally dabbled in technology stocks. But he bought Apple with two fists, and he's more than happy to discuss his ardor for AAPL. As he has said more than once on CNBC, he loves the power of Apple's brand and its ecosystem of products (such as the iPhone and iPad) and services (such as Apple Pay and iTunes).

"It's probably the best business I know in the world," Buffett told CNBC in early 2020. "And that is a bigger commitment that we have in any business except insurance and the railroad."

Bank of America

Buffett spent most of 2020 and 2021 hacking and slashing at his various bank-stock holdings. But he remains as committed as ever to Bank of America (BAC).

Buffett's interest in BAC dates back to 2011, when he swooped in to shore up the firm's finances in the wake of the Great Recession. In exchange for investing $5 billion in the firm, Berkshire received preferred stock yielding 6% and warrants giving Berkshire the right to purchase BofA common stock at a steep discount. (The Oracle of Omaha exercised those warrants in 2017, netting a $12 billion profit in the process.)

Most recently, at the end of Q4 2023, Berkshire held 1.0 billion BAC shares. The stake accounts for 10% of the holding company's equity portfolio, making the second-largest position.

American Express

American Express continues to endure as one of Warren Buffett's favorite investments.

Buffett likes to say this his preferred holding period is "forever," and AmEx is one of the premier examples. Berkshire entered its initial stake in the credit card company in 1963, when a struggling AmEx badly needed capital. Buffett obliged, getting favorable terms on his investment. He has played the role of white knight many times over the years, including during the 2008 financial crisis, as a means to get stakes in good companies at a discount. (Think: Goldman Sachs (GS) and Bank of America.)

Berkshire Hathaway is by far the company's largest shareholder.

Buffett praised the power of AmEx's brand at Berkshire's 2019 annual meeting. "It's a fantastic story, and I'm glad we own [so much] of it," he said. Of course he's glad: A roughly 1,000% total return over the past quarter-century would make most investors glow.

Coca-Cola

Buffett, an unabashed fan of Cherry Coke, started investing in Coca-Cola stock soon after the stock market crash of 1987. In his 1988 letter to Berkshire shareholders, Buffett said he expected to hold on to the stock "for a long time."

Three decades later, he has proven true to his word. Berkshire is KO's largest shareholder with 9.3% of its shares outstanding, and Coca-Cola remains among the most iconic of Buffett stocks.

Coca-Cola made a brief appearance as a component of the Dow Jones Industrial Average in the 1930s. Shares were added back to the Dow in 1987, and they've remained a stalwart member ever since.

Coca-Cola's stock performance was a lifesaver in an otherwise terrible 2022. Shares generated a total return of 10.6% for the 52 weeks vs a total return of -18.1% for the S&P 500.

KO has also been an income investor's dream. The beverage maker, widely considered one of the best dividend stocks for dependable dividend growth, has increased its payout annually for more than 60 consecutive years.

Chevron

For a while, Buffett couldn't seem to make up his mind about whether he liked or loathed Chevron. Now, however, it's abundantly clear that Buffett is a huge fan of the integrated energy major.

Berkshire Hathaway initiated a position in CVX of more than 48 million shares in the fourth quarter of 2020 valued at $4.1 billion. Although energy prices weren't expected to make huge moves in 2021 after a considerable rebound in late 2020, the outlook for oil and gas was much improved and expected to get better as the global economy recovered.

Chevron specifically was well positioned, as it took advantage of the worst of the industry's woes in July 2020 by acquiring Noble Energy in a $5 billion all-stock transaction. The company's scale, asset quality and reserves made it one of the healthiest players in an industry where a lot of players were on injured reserve. Also noteworthy was its standing as a Dividend Aristocrat, with 37 years of uninterrupted dividend growth under its belt.

Chevron remains Berkshire's fifth-largest holding with a 5.4% weighting in the portfolio. CVX now makes up less than 6% of the Berkshire portfolio, down from almost 10% at the end of 2022.

Related content

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade stocks or other securities. Rather, he dollar-cost averages into cheap funds and index funds and holds them forever in tax-advantaged accounts.

-

Stock Market Today: Nasdaq Spirals as Netflix Nosedives

Stock Market Today: Nasdaq Spirals as Netflix NosedivesA big earnings boom for credit card giant American Express helped the Dow notch another win.

By Karee Venema Published

-

Get These 40 Earth Day Deals and Discounts

Get These 40 Earth Day Deals and DiscountsMonday, April 22, is Earth Day. Many of your favorite retailers are celebrating with deals on sustainable products, recycling services, and more

By Kathryn Pomroy Published

-

Stock Market Today: Nasdaq Spirals as Netflix Nosedives

Stock Market Today: Nasdaq Spirals as Netflix NosedivesA big earnings boom for credit card giant American Express helped the Dow notch another win.

By Karee Venema Published

-

Stock Market Today: S&P 500, Nasdaq Extend Losing Streaks

Stock Market Today: S&P 500, Nasdaq Extend Losing StreaksThe two indexes have closed lower for five straight sessions.

By Karee Venema Published

-

Buy eBay and Sell Etsy, Morgan Stanley Says

Buy eBay and Sell Etsy, Morgan Stanley SaysMorgan Stanley is bullish on eBay and bearish on Etsy. Here’s what you need to know.

By Joey Solitro Published

-

Why Taiwan Semiconductor Stock Is Falling After Earnings

Why Taiwan Semiconductor Stock Is Falling After EarningsTaiwan Semiconductor beat expectations for the first quarter but its stock is notably lower. Here's why.

By Joey Solitro Published

-

Stock Market Today: Dow Slips After Travelers' Earnings Miss

Stock Market Today: Dow Slips After Travelers' Earnings MissThe property and casualty insurer posted a bottom-line miss as catastrophe losses spiked.

By Karee Venema Published

-

Why United Airlines Stock Is Flying Higher After Earnings

Why United Airlines Stock Is Flying Higher After EarningsUnited Airlines beat expectations for the first quarter and its stock is by soaring. Here's what you need to know.

By Joey Solitro Published

-

Super Micro Computer: Why This Hot Stock Could Hit $1,500

Super Micro Computer: Why This Hot Stock Could Hit $1,500Super Micro Computer's long-term AI revenue potential is underappreciated, Loop Capital says. Here's what you need to know.

By Joey Solitro Published

-

Stock Market Today: Stocks Stabilize After Powell's Rate-Cut Warning

Stock Market Today: Stocks Stabilize After Powell's Rate-Cut WarningThe main indexes temporarily tumbled after Fed Chair Powell said interest rates could stay higher for longer.

By Karee Venema Published