Should You Use a 25x4 Portfolio Allocation?

The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

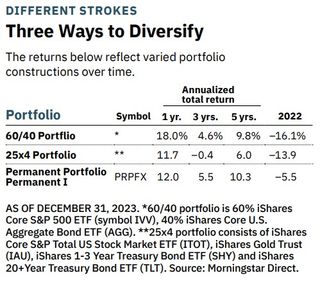

After a disastrous market in 2022, many strategists claimed that the 60/40 portfolio, which holds 60% of assets in stocks and 40% in bonds, was dead. In its place, some strategists suggested investors consider the 25/25/25/25 portfolio, or 25x4 portfolio, which calls for dividing your assets evenly into stocks, bonds, commodities and cash.

"We believe the 25/25/25/25 portfolio will outperform the 60/40 portfolio in the 2020s," says Michael Hartnett, a chief investment strategist at BofA Global Research.

The simplest reason is that interest rates and inflation are higher than in decades past. The 60/40 portfolio worked best when inflation and interest rates were low or falling, says Hartnett. But this decade he expects higher inflation and interest rates, with added volatility, creating market conditions that are well suited for cash and commodities to outperform bonds and stocks.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So far, though, that hasn't played out. Although the 25x4 portfolio did marginally better than a 60/40 portfolio in 2022, over longer periods, it has lagged. A 60/40 portfolio has gained 4.6% annualized over the past three years; a 25x4 portfolio has lost 0.4% on average per year.

Think twice before switching to the 25x4 portfolio

In short, don't count the 60/40 portfolio out yet. "Over the years, the 60/40 portfolio has held up for investors, and it's actually provided wonderful returns with low risk levels," says Jan Holman, director of adviser education at Thornburg Investment Management.

This isn't the first go-around for the 25x4 portfolio. It got its start decades ago by way of Harry Browne, the late investment adviser and two-time Libertarian Party presidential candidate (in 1996 and 2000). In Browne's so-called Permanent Portfolio strategy, investors held 25% in cash, 25% in gold, 25% in long-term bonds and 25% in stocks, rebalancing annually. The idea was that the four asset classes would help minimize risk no matter the market or economic condition.

Browne helped develop a no-load mutual fund tied to the 25x4 strategy called the Permanent Portfolio Permanent (PRPFX), which launched in 1982. But it's not a straight-up version of his approach. Instead, the fund is more "dynamic," says fund manager Michael Cuggino.

It targets an allocation of 30% stocks, 25% precious metals (20% in gold and 5% in silver) and 45% in bonds and cash (10% of which is denominated in Swiss Francs). The stock side of the portfolio includes a mix of real estate and natural-resources stocks, such as Prologis (PLD) and Exxon Mobil (XOM), as well as aggressive growth stocks, such as Nvidia (NVDA) and Meta Platforms (META). "The fund's goal is to outpace inflation," says Cuggino, a fund manager since 2003.

The fund's annualized 5.7% return over the past decade has indeed beaten the 2% average inflation rate over the period. And it has been far less volatile over that time than its peers (moderate allocation funds), which typically hold about 60% of assets in stocks. But 63% of its peers did better, generating an average 6.1% annualized 10-year return.

That's evidence that it's important to think through any allocation strategy carefully before you implement it. "Asset allocation should always be decided on an individual basis and in the context of a comprehensive financial plan, not based on a gimmick," says Gordon Achtermann, a certified financial planner in Fairfax, Virginia. As an alternative, consider a low-cost target-date fund. "You won't beat the market," he says, "but you won't get badly hurt, either."

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related content

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Charitable Remainder Trust: The Stretch IRA Alternative

Charitable Remainder Trust: The Stretch IRA AlternativeThe SECURE Act killed the stretch IRA, but a properly constructed charitable remainder trust can deliver similar benefits, with some caveats.

By Brandon Mather, CFP®, CEPA, ChFEBC® Published

-

Three Ways to Take Control of Your Money During Financial Literacy Month

Three Ways to Take Control of Your Money During Financial Literacy MonthBudgeting, building an emergency fund and taking advantage of a multitude of workplace benefits can get you on track and keep you there.

By Craig Rubino Published

-

What Is Proxy Season and Should You Vote?

What Is Proxy Season and Should You Vote?Proxy season is upon us, allowing investors to weigh in on corporate leadership and policies. Here, we look at proxy season and whether you should vote.

By Kyle Woodley Published

-

Stock Market Today: Stocks Tumble After a Hot Inflation Print

Stock Market Today: Stocks Tumble After a Hot Inflation PrintEquities retreated after inflation data called the Fed's rate-cut plans into question.

By Dan Burrows Published

-

Stock Market Today: Stocks Swing Lower as March Jobs Report Looms

Stock Market Today: Stocks Swing Lower as March Jobs Report LoomsThe main indexes turned negative in mid-afternoon trading as all eyes turned to tomorrow morning's key employment update.

By Karee Venema Published

-

Stock Market Today: Dow Sinks 396 Points as UnitedHealth Spirals

Stock Market Today: Dow Sinks 396 Points as UnitedHealth SpiralsLarge-cap healthcare stocks slumped after regulators set a disappointing reimbursement rate for Medicare Advantage plans.

By Karee Venema Published

-

Stock Market Today: Stocks End Mixed To Start Q2

Stock Market Today: Stocks End Mixed To Start Q2Strong readings on the manufacturing data lowered expectations for a June rate cut and kept investors on edge.

By Karee Venema Published

-

Q2 Investing Outlook: Experts Eye Earnings, Rate Cuts & More

Q2 Investing Outlook: Experts Eye Earnings, Rate Cuts & MoreInflation, interest rates and corporate earnings will be top of mind for investors in the second quarter.

By Karee Venema Published

-

What Experts See In Economic Signals For 2024

What Experts See In Economic Signals For 2024Experts assess economic signals for 2024.

By Simon Constable Published

-

Stock Market Today: Stocks Close Higher After Nvidia's Reversal

Stock Market Today: Stocks Close Higher After Nvidia's ReversalThe main indexes erased early losses Tuesday as mega-cap tech stock Nvidia swung higher.

By Karee Venema Published